Our industry is gradually entering into a phase of maturity. Gradually because, by its very essence, the level of creativity in IT means it will never definitively be a mature industry. Every year new inventions bring changes that completely transform the way things are done to the extent that you don’t know how to make profitability plans with such a constant succession of technological trends.

These days no position is sustainable. Nokia, Blackberry, Netscape, Novell, 3Com, MSN, Second Life, Alcatel… so many former number ones that have lost their leadership because of technological changes or radically different market approaches. Who will it be next? Apple, Facebook, Microsoft…it seems inconceivable today, but who knows, tomorrow?

Of course being leader has its advantages, but its disadvantages too. There is no one to help you make your first mark and if you want to see how you compare to others you have to look behind. It is not always easy to do both at the same time. As in cycling, the amount of energy spent to stay at the front of the race is often greater than that needed to catch up with the leader. Being good or even excellent is not enough. You need to stay two steps ahead of those who follow behind you.

With this in mind, how can a manufacturer or a supplier of means imagine their future? Which choices should they be making today to ensure they will be in a strong position tomorrow, and what are the pitfalls to avoid?

In all this haze, the “omens”, that are the market analysts, say that the European market as a whole will be flat, that is, in spite of the boom for certain technologies the market will remain flat, which amounts to saying that for certain products there will be a severe drop off. In this depressed market a ray of sunshine will come from process externalization; led by the Cloud, with mobility, social networks for enterprises and the optimization of client knowledge processes, (particularly Big Data), following close behind. For the user, the Cloud is not revolutionary at all; it is just a different, simpler and more universal means of doing something they already did before. For the industry as a whole, however, it is a revolution in terms of the economic models, the decision cycles and overall business organization. It is a real transformation and as such it brings both threats and opportunities.

What changes in the Cloud is that usage becomes more important than internal infrastructure – that is usage of software or services (the two are often confused). It is vital to understand this fact and to take it into account when making strategic plans.

Usage (i.e: demand) will dominate the market. We are at a turning point. The market is swinging from supply towards demand, where the customer is key.

Once you accept this, how will it impact your strategy? Obviously, you will need to be able to monitor solution usage. This will be primordial, hence the rise in BI, Big Data and company social networks – all means to increase growth by knowledge. Anything that will increase usage will also be key, be it mobility, interconnection, web services or the contextualization of usage. However, what is the most strategic is being able to control or make an impact on the flux, because if you can do this you can influence requirement.

These days no position is sustainable. Nokia, Blackberry, Netscape, Novell, 3Com, MSN, Second Life, Alcatel… so many former number ones that have lost their leadership because of technological changes or radically different market approaches. Who will it be next? Apple, Facebook, Microsoft…it seems inconceivable today, but who knows, tomorrow?

Of course being leader has its advantages, but its disadvantages too. There is no one to help you make your first mark and if you want to see how you compare to others you have to look behind. It is not always easy to do both at the same time. As in cycling, the amount of energy spent to stay at the front of the race is often greater than that needed to catch up with the leader. Being good or even excellent is not enough. You need to stay two steps ahead of those who follow behind you.

With this in mind, how can a manufacturer or a supplier of means imagine their future? Which choices should they be making today to ensure they will be in a strong position tomorrow, and what are the pitfalls to avoid?

In all this haze, the “omens”, that are the market analysts, say that the European market as a whole will be flat, that is, in spite of the boom for certain technologies the market will remain flat, which amounts to saying that for certain products there will be a severe drop off. In this depressed market a ray of sunshine will come from process externalization; led by the Cloud, with mobility, social networks for enterprises and the optimization of client knowledge processes, (particularly Big Data), following close behind. For the user, the Cloud is not revolutionary at all; it is just a different, simpler and more universal means of doing something they already did before. For the industry as a whole, however, it is a revolution in terms of the economic models, the decision cycles and overall business organization. It is a real transformation and as such it brings both threats and opportunities.

What changes in the Cloud is that usage becomes more important than internal infrastructure – that is usage of software or services (the two are often confused). It is vital to understand this fact and to take it into account when making strategic plans.

Usage (i.e: demand) will dominate the market. We are at a turning point. The market is swinging from supply towards demand, where the customer is key.

Once you accept this, how will it impact your strategy? Obviously, you will need to be able to monitor solution usage. This will be primordial, hence the rise in BI, Big Data and company social networks – all means to increase growth by knowledge. Anything that will increase usage will also be key, be it mobility, interconnection, web services or the contextualization of usage. However, what is the most strategic is being able to control or make an impact on the flux, because if you can do this you can influence requirement.

ISVs are the future for hardware manufacturers

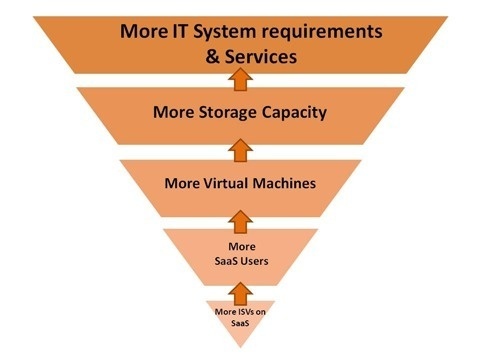

To put it simply, if I am a hardware manufacturer and I believe that in the future usage will take priority and that this usage will be in the Cloud, the challenge I face is to direct the demand for architectures towards my own solutions.

The challenge will be, on the one hand managing the major accounts which are going to integrate the Cloud into their internal architecture, for these it will be “business as usual”, and on the other hand managing a new channel made up of “resellers” who won’t actually be reselling anything but usage. These “resellers” are companies supplying hosting, be they software publishers, datacenters or any other company selling shared resources. To impact this, one will need to intervene at demand level, the demand being for the software or the managed services.

ISVs will soon be the industry’s Holy Grail. We are still in the early days, with less than 20% of software publishers offering their solutions in SaaS mode. What is more, it seems publishers stay with the same hosting company for at least 3 to 5 years. You don’t have to be a genius to realize that if a major ISV for any given vertical market chooses a hosting company which is detrimental to your own market, every time they get a new user it will reinforce your competitor’s position as opposed to your own. Being able to recruit the right ISVs and to accompany the migration of their SaaS applications to your hosting companies will be key to your strategy. Naturally, in order to be able to do this you have to already have recruited hosting companies otherwise you will soon be selling even more cheaply in an ever-declining market. So you see it is not about operational execution, but a strategic decision to stay at least one step ahead.

Dell’s fall in popularity should raise questions for all manufacturers, or at least for the major ones. To mutate you have to be discrete, otherwise you are too exposed and too fragile. Having conquered 50% of the indirect market, is Dell preparing a second mutation with the help of …Microsoft? Q.E.D?

The challenge will be, on the one hand managing the major accounts which are going to integrate the Cloud into their internal architecture, for these it will be “business as usual”, and on the other hand managing a new channel made up of “resellers” who won’t actually be reselling anything but usage. These “resellers” are companies supplying hosting, be they software publishers, datacenters or any other company selling shared resources. To impact this, one will need to intervene at demand level, the demand being for the software or the managed services.

ISVs will soon be the industry’s Holy Grail. We are still in the early days, with less than 20% of software publishers offering their solutions in SaaS mode. What is more, it seems publishers stay with the same hosting company for at least 3 to 5 years. You don’t have to be a genius to realize that if a major ISV for any given vertical market chooses a hosting company which is detrimental to your own market, every time they get a new user it will reinforce your competitor’s position as opposed to your own. Being able to recruit the right ISVs and to accompany the migration of their SaaS applications to your hosting companies will be key to your strategy. Naturally, in order to be able to do this you have to already have recruited hosting companies otherwise you will soon be selling even more cheaply in an ever-declining market. So you see it is not about operational execution, but a strategic decision to stay at least one step ahead.

Dell’s fall in popularity should raise questions for all manufacturers, or at least for the major ones. To mutate you have to be discrete, otherwise you are too exposed and too fragile. Having conquered 50% of the indirect market, is Dell preparing a second mutation with the help of …Microsoft? Q.E.D?

Consulting Services

Consulting Services